Foto: red-feniks - shutterstock.com

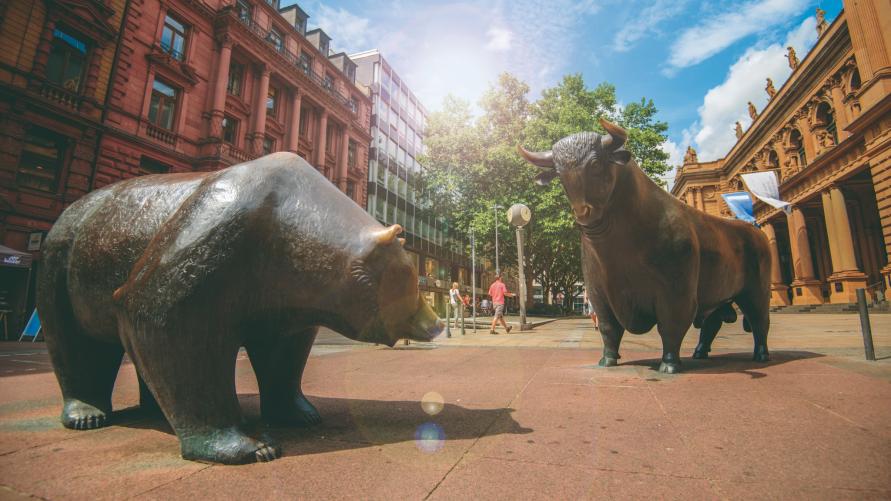

Banking, finances, and taxes

Even in the global digitized world, each country has its own specifics when it comes to banking and finance. It is therefore important for newcomers to familiarize themselves with the German system.

Having a bank account is essential to your existence in Germany. You cannot pay the rent without one, or get paid by your employer. One of the first things you need to do when you begin your new life here is to go down to the local bank and open an account.

Individuals can choose between three types of banks: large commercial banks; full-service savings banks (Sparkassen) and credit cooperatives (Kreditgenossenschaften). The latter are the smallest of the three, with their offices located in the neighborhoods of towns. To open an account at a bank, make sure to take along your passport, and your residence permit or comparable documentation.

THE GIRO OR CURRENT ACCOUNT

The most common and convenient account is the current account or checking account (Girokonto), which allows you to put in and take out money as you need it. The banks will even extend you a credit line, which can amount to thousands of euros, depending on your regular monthly income. Most banks charge you a monthly management fee for your current account, usually billed quarterly. If you come from a country where current or checking accounts are absolutely free, you may find this practice strange.

These fees and additional charges differ from bank to bank and can sometimes tally up to € 200 a year. Also, since some of the additional charges are hard to detect at first glance, shopping around for the best offer can prove a tad difficult. Your best shopping guide in this regard is the

magazine Finanztest, published by Germany’s leading consumer guardian, Stiftung Warentest. Early each year, Finanztest puts together a detailed list of various banking charges. In addition, more consumer-oriented banks and most direct banks now offer free current accounts and online banking.

INTEREST BEARING ACCOUNTS

There are options for earning higher interest on your savings, as long as you do not need ready access to your money.Such accounts include fixed-term deposits and money market accounts, and the terms can run from one month to five years. The longer you keep your money in these accounts, the higher the interest you earn on them.

One very important point to keep in mind: you do not automatically receive your money with higher interest when the fixed term runs out. To get the entire lump sum, you have to give official notice before the expiration of the term. Some banks will send you a written reminder of the impending end of the term and your required notice period, but others expect their customers to keep track of all these details themselves. If you do not hand in the official notice form by the appropriate date, the account is either rolled over for another fixed period or converts to a lower interest-bearing account, with all the aforementioned restrictions.

Direct Banking

Direct banks represent a welcome, consumer-oriented trend in the German banking sector.

Direct Debits, Checks and Balances

Most payments in Germany are made via direct debit from one account to another.

Regular Payments

For payments of ongoing bills, it is in many ways highly advisable (and convenient) to set up a standing order.

Maestro Card

Shortly after you open your current (Giro) account, you will be sent a bank card.

Taxes

As is the case in most countries, the German tax system is complex.

Retirement, Unemployment and Nursing Care Insurance

Generally speaking, social welfare contributions are shared just about equally between employer and employee.